By Cole Lauterbach/Illinois Radio Network

SPRINGFIELD – An argument is brewing over how Illinois’ small businesses would fare under a progressive tax.

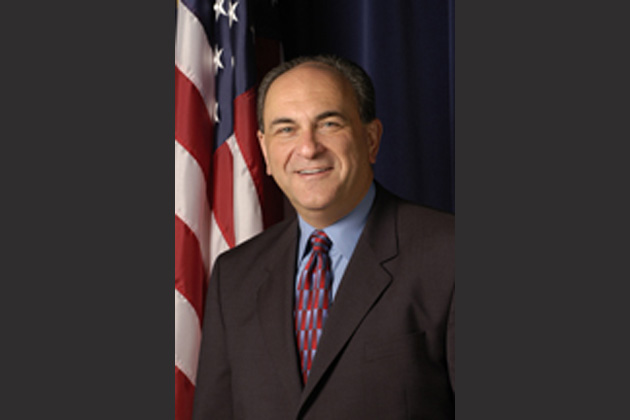

State Rep. Lou Lang (D-Skokie) said most small businesses would be better off under his progressive tax proposal.

“Over 90 percent of small businesses would get a tax cut,” Lang told reporters at a May 2 news conference.

But Kim Maisch, National Federation of Independent Business’ Illinois director, said that’s misleading.

“If you run a small business and have expensive inventory like cars, that’s all run through your personal income taxes,” she said. “So it may look like you’re pocketing a lot of money, but in essence, you’re not.”

Gov. Bruce Rauner said this type of burden would send more job creators out of state.

If we put a high income tax on successful people, business owners, small-business owners, many more will leave. Many more than have already left,” Rauner said.

According to IRS data, Illinois’ income tax for more than 31,000 small businesses would jump to at least 8 and three-quarter percent under Lang’s proposal; higher than what corporations pay.