By Greg Bishop/Illinois Radio Network

SPRINGFIELD – A leading Illinois House Democrat wants to increase taxes in Illinois by $1.9 billion by ushering in a graduated income tax.

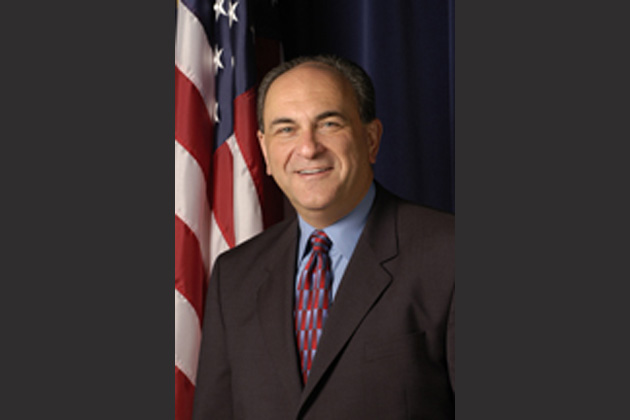

House Deputy Majority Leader Lou Lang proposed a graduated income tax Friday. Currently all Illinois taxpayers pay a flat income tax of 3.75 percent. The proposed tax rates range from 3.5 percent for income up to $100,000, to 9.75 percent on income more than $1 million.

Taxpayers Federation of Illinois President Carol Portman said creating a complicated tax bracket system could lead high income earners to find other ways to lessen their tax burden, like moving their money out of the state.

“If there’s enough money at stake and the tax rates are higher that makes it more likely,” Portman said.

Portman said taxpayers want to ensure they’re getting what they pay for.

“A graduated rate, and just making that change alone, I don’t think can be that one big magical cure to the problem,” Portman said.

Governor Bruce Rauner Press Secretary Catherine Kelly said in a statement a progressive income tax, quote, “would be the straw that breaks the Illinois economy’s back.” Kelly said there needs to be structural reforms to grow the economy.

Lang’s measure says the rates would change only if an amendment to the state constitution is approved by voters this year. The measure to allow such a vote was introduced Thursday.