By Dave Dahl

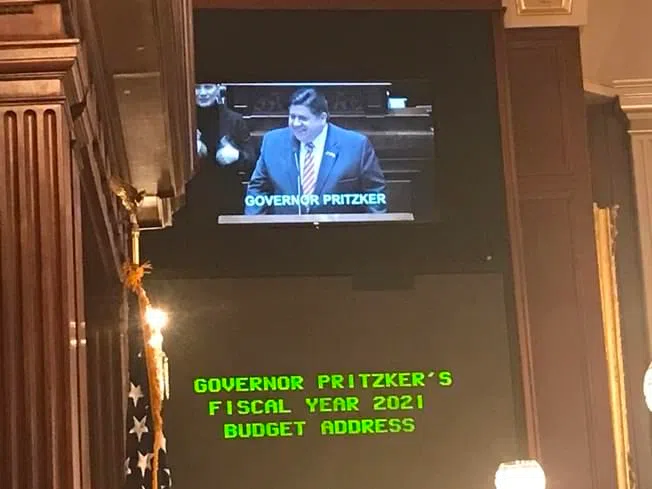

SPRINGFIELD – The theme of Gov. Pritzker’s budget message Wednesday afternoon was “optimism,” but he was not above introducing a little hard-sell of his graduated income tax.

If Illinois voters amend the Constitution to change the income tax, the switch takes effect halfway through the fiscal year.

“To address the uncertainty in our revenues, this budget responsibly holds $1.4 billion in reserve,” Pritzker said, “until we know the outcome in November. Because this reserve is so large. it inevitably cuts into some of the things we hold most dear.”

Remember evidence-based K-12 education, pumping an extra 350 (m) million dollars into the system? Pritzker’s plan accounts for only 200 (m) million unless that income tax change passes.

The proposal, including the estimated $1.4 billion growth from the first six months of a graduated income tax, is to spend $42 billion.

The fiscal year begins July 1.

Dave Dahl can be reached at news@wjbc.com